Unlocking the Benefits of Payroll Tax Credits with Qbox: Guide

Contents

For businesses of all sizes, maintaining current with tax credits and deductions is essential in the always-evolving world of payroll management. This article seeks to provide helpful ideas on how to optimize the benefits of the payroll tax credit and employee retention tax credit (ERTC) in 2023.

We'll examine the ideal methods for utilizing QuickBooks for payroll administration, particularly with the aid of Qbox, a superb program made to work in perfect harmony with QuickBooks Desktop. Whether you're a small business owner or a payroll specialist, this thorough guide will arm you with the information you need to streamline your payroll procedures and benefit from priceless tax advantages.

Understanding Payroll Tax Credits

Let's explore the world of payroll taxes together! One way governments incentivize companies is by offering various credits - including ones designed around retaining staff members and driving economic growth among them. Payroll credits can reduce an employer’s overall liability come tax season; freeing up extra resources and creating ideal circumstances for long-term employee development and stability throughout your company!

That said, our focus here lies solely on one such type of incentive: The Employee Retention Tax Credit (ERTC). As a response to the economic difficulties caused by COVID-19, ERTC offers a refundable tax credit for qualifying businesses facing significant revenue declines or government restrictions. By examining eligibility guidelines, criteria for qualification, and minimum qualified wages, you can empower your business with a powerful resource come tax time.

Streamlining Payroll Processes with QuickBooks

All sizes of organizations turn to QuickBooks when it comes to managing payroll effectively. You may streamline company operations, lower error rates, and save important time by putting best practices for understanding payroll in QuickBooks into practice. Let's look at some essential suggestions to get the most out of this adaptable tool:

1. Establish precise employee profiles

Making sure your employee profiles in QuickBooks are complete and current is one of the fundamental stages. Include crucial information such as tax exemptions, deductions, and withholding information. Payroll calculations will be accurate as a result, and discrepancies will be avoided.

2. Create regular payroll schedules

To preserve order and fulfill legal requirements, a regular and consistent payroll schedule is essential. Establish a precise pay period and payday that are in line with your company's requirements to make sure that your employees are paid on time.

3. Monitor attendance and time

Strong time-tracking capabilities provided by QuickBooks make it simple to record the hours that workers work. Make use of these capabilities to precisely track and record attendance, automate wage calculations, and lower the possibility of mistakes.

4. Implement automated payroll tax computations

Payroll taxes might be complicated to calculate, but QuickBooks makes the process simpler by automating payroll tax computations. You may guarantee precise and legal tax withholdings by configuring the relevant tax rates and data within the software.

You may use the power of QuickBooks to automate your payroll procedures, reduce errors, and guarantee smooth operations by putting these best practices into practice. Check out our article, "Best Practices for Learning How to Do Payroll in Quickbooks," for thorough advice on mastering payroll management within the QuickBooks program.

Integrating Qbox for Streamlined Payroll Management

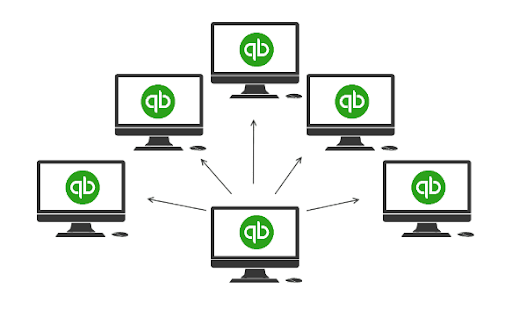

QuickBooks Desktop is enhanced by Qbox, an innovative piece of software from CoralTree, which offers remote access and team collaboration features for QuickBooks files. Because of its seamless connection, businesses can streamline payroll management while maintaining data security, accuracy, and productive teamwork.

With Qbox, many users can collaborate on the same QuickBooks file at once without the need for file transfers or version control complications. For organizations of all sizes, this cooperative strategy boosts productivity and makes payroll management simpler.

Leveraging Payroll Tax Credits with Qbox

After looking at the fundamentals of payroll tax credits and the advantages of Qbox integration, let's now look at how these two factors interact to optimize the possible advantages for your company.

1. Reliable reporting and tracking

Real-time collaboration is made possible with Qbox, making it simpler to collect and report correct payroll data. You can make sure that all payroll data is accurate and up to date by having numerous people work simultaneously on the same QuickBooks file. This degree of cooperation ensures compliance with payroll tax credit regulations and considerably lowers the possibility of errors.

2. Coherent record-keeping

A unified platform for storing and accessing payroll-related documents is offered by Qbox. By securely storing personnel data, tax returns, and other pertinent papers, you may do away with physical paperwork and streamline the documentation procedure. When claiming payroll tax credits, this feature is very useful because it makes it simple to retrieve and present proof of eligibility.

3. Boosted information security

With bank-level encryption as a top priority, Qbox makes sure that private payroll data is shielded from unauthorized access. You can rest easy knowing your data is secure and in compliance with industry standards if you use Qbox to manage your payroll procedures.

4. Streamlined teamwork

No matter where they are physically located, the payroll staff may collaborate easily with one another thanks to Qbox. The benefits of payroll tax credits are maximized because of the improved communication, coordination, and knowledge sharing that this collaborative atmosphere generates.

Claiming Employee Retention Tax Credits

Let's go deeper into claiming the employee retention tax credit (ERTC) now that we have discussed the principles of payroll tax credits and how Qbox integration can improve your payroll procedures.

"How does the employee retention tax credit work?" and "How do I file a payroll tax credit?" are common questions that people ask. The employee retention tax credit or the Payroll retention credit is an excellent incentive that helps companies keep their personnel during difficult times. Follow these essential steps to claim this credit:

1. Establish eligibility

Review the Internal Revenue Service's (IRS) eligibility requirements first. The main question to be answered here is, Who qualifies for the payroll tax credit? The impact of governmental limitations or a sizable income decrease is another frequent ERTC's qualifying criteria. Examine your company's finances and activities carefully to see if you match the standards.

2. Determine the qualified wages for the employee retention credit program

The qualified wages for the employee retention credit program must be identified once eligibility has been established. This comprises compensation given to qualified workers during the designated times and within specific bounds. To precisely establish the portion of wages that can be taken into account for the credit, be aware of the IRS's guidelines.

3. Compile supporting evidence

Collect the relevant proof of the pandemic's effect on your company and the qualification of your personnel to support your application for the Payroll retention Credit. Payroll records, bank accounts, and any other pertinent information that show a drop in revenue or the impact of governmental limitations may be included in this.

4. Apply for an ERTC

To apply for the ERTC, follow the IRS filing instructions. This normally entails filling out the right forms and providing the required data and supporting paperwork. To increase your chances of earning the credit, make sure to carefully give accurate facts and submit your claim within the required time frames.

You can successfully complete the ERTC claim process by adhering to these guidelines. Never forget to get advice from a tax expert or use the official IRS sites for customized advice catered to your particular situation. Utilizing the ERTC effectively can help your company stay financially strong and retain its valuable personnel during trying times.

Revolutionize Your Payroll Management with Qbox and Unlock the Benefits of Payroll Tax Credits!

Employers who care about employee retention, tax savings, and long-term financial health would do well to optimize their payroll procedures and take advantage of available payroll tax credits. Streamlining payroll management and accessing payroll tax credits are both possible after integrating Qbox with QuickBooks Desktop.

Make use of Qbox's integrated tools for improved accuracy, productivity, and compliance, and make sure you're familiar with best practices for using QuickBooks. Also, see if you qualify for the employee retention tax credit.

Sign up for Qbox today and get a free 30-day trial to see how this cutting-edge software can transform your payroll processes and help you make the most of available payroll tax credits.